Mandatory to quote HSN/ SAC code on invoices w.e.f 01/04/2021

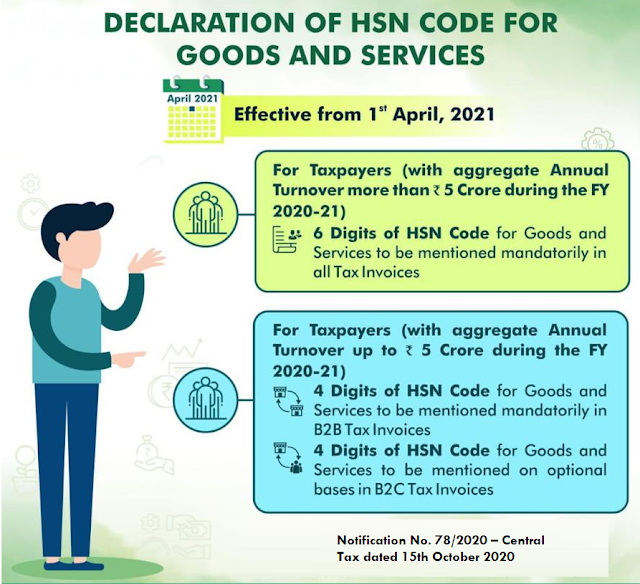

CBDT vide Notification No. 78/2020 – Central Tax dated 15th October 2020, has made it mandatory to mention 4/6-digit HSN code issuing Goods and Services Tax (GST) invoices. Prior to the date , quoting of HSN /SAC code was not mandatory on invoices for taxpayers with turnover less than 1.5 Cr. And applicability of HSN code was based on turnover.

Applicability of HSN /SAC code on sales invoices :

| Serial Number | Aggregate Turnover in the Preceding Financial Year | Number of Digits of Harmonised System of Nomenclature Code (HSN Code) |

|---|---|---|

| 1 | Up to rupees five crores | 4 |

| 2 | More than rupees five crores | 6 |

A registered person having aggregate turnover up to five crores rupees in the previous financial year may not mention the HSN Code, in a tax invoice issued to unregistered persons (i.e. B2C invoices)

Important points w.r.t HSN code :

-

- For exports 8 digits to be mentioned on export invoices and is also a requirement as per Foreign Trade Policy (FTP);

- It’s optional to show HSN codes on B2C invoices for taxpayers with turnover below Rs. 5 Crores;

- 49 chemicals as per Notification no. 90/2020 dated 01/12/2020 have to be mandatorily shown under 8 digits code.

- It required to incorporate a minimum of 6 digits of the Harmonized System of Nomenclature (HSN) code in e-Invoices starting from December 15, 2023.

Where to find HSN /SAC Code?

You can get list of SAC & HSN code on common GST portal.