All About Nil EPF Return Filing

Nil EPF Return refers to the submission of an EPF return by an employer registered with the Employees’ Provident Fund Organisation (EPFO) when there are no active employees contributing to the Employees’ Provident Fund (EPF) for a particular month. Filing a Nil return ensures compliance with EPFO regulations, even in the absence of contributory members. Below is a comprehensive guide covering the process, requirements, legal obligations, and other key aspects of Nil EPF return filing.

1. What is a Nil EPF Return?

A Nil EPF return is filed by an employer to declare that no EPF contributions are due for a specific month because:

-

- There are no employees eligible for EPF contributions (e.g., all employees have left, or their basic salary exceeds the EPF wage ceiling of ₹15,000 per month).

- The organization is temporarily non-functional or has no employees.

- The organization has registered for EPF but has not yet hired any eligible employees.

Filing a Nil return is mandatory for employers with an active EPF registration to maintain compliance and avoid penalties, even if no contributions are made.

2. Why File a Nil EPF Return?

Filing a Nil EPF return serves several purposes:

-

- Compliance with EPFO Regulations: Employers with an EPF registration must file returns every month, regardless of whether contributions are made. Non-filing can lead to penalties or legal action.

- Record Maintenance: It keeps the EPFO informed that the organization has no contributory members, maintaining transparency and accurate records.

- Avoiding Notices: Failure to file Nil returns may trigger notices from the EPFO, assuming non-compliance.

- Prevents Penalties: Timely filing avoids fines, legal repercussions, or delays in employee benefits.

3. When to File a Nil EPF Return?

A Nil EPF return is required in the following scenarios:

-

- No Eligible Employees: If all employees have left the organization or their basic salary exceeds ₹15,000 (making EPF contributions optional).

- Temporary Closure: The organization is not operational due to reasons like seasonal shutdowns or financial constraints.

- New Registration with No Employees: The organization has voluntary obtained an EPF registration but has not yet hired eligible employees.

- Post-Closure but Pre-Surrender: The organization has ceased operations but has not yet surrendered its PF code.

The due date for filing EPF returns, including Nil returns, is the 15th of the subsequent month. For example, the return for June 2025 must be filed by July 15, 2025.

4. Step-by-Step Process to File a Nil EPF Return

Unlike regular EPF returns, which involve uploading an Electronic Challan cum Return (ECR) file, Nil returns do not require an ECR file. Instead, employers file a direct challan to indicate no contributions. Below is the step-by-step process:

1️⃣Step 1: Log in to the EPFO Employer Portal

-

- Visit the EPFO Unified Portal (https://unifiedportal-emp.epfindia.gov.in).

- Log in using the establishment’s User ID (PF Code) and Password.

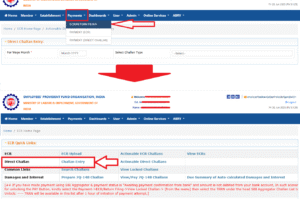

2️⃣Step 2: Navigate to the Payments Section

-

- On the main dashboard, locate the “Payments” tab in the primary menu.

- Select “ECR/Return Filing” from the dropdown menu.

3️⃣Step 3: Select Challan Entry

-

- Click on “Challan Entry” to initiate the Nil return filing process.

4️⃣Step 4: Enter Details

- Wage Month: Select the month and year for which the Nil return is being filed (e.g., June 2025).

- Challan Type: Choose “Administrative/Inspection Charges Challan”.

- Enter the following amounts (if applicable):

- A/C No. 2 (EPF Admin Charges): ₹75 per month (minimum for non-functional establishments with no contributory members).

5️⃣Step 5: Verify and Finalize

-

- Review the entered details for accuracy.

- Click “Next” to generate the challan.

- Finalize the challan to create a Temporary Return Reference Number (TRRN) for tracking.

6️⃣Step 6: Make Payment (if applicable)

-

- If administrative charges are applicable (₹75 for A/C No. 2), proceed to the “Payments” section.

- Select the TRRN and complete the payment via online banking.

- Download the payment receipt for records.

7️⃣Step 7: Submission

-

- After payment (if required), the Nil return is considered filed. No further action is needed unless notified by the EPFO.

Note: If no payment is required (e.g., no administrative charges for certain cases), simply submitting the Nil return on the portal completes the process.

5. Points to be kept in mind:

- No ECR File Needed: Unlike regular EPF returns, Nil returns do not require uploading an ECR text file, as there are no employee contributions to report.

- Mandatory for Registered Employers: Even with zero employees, employers must file Nil returns until the PF code is surrendered.

- Minimum Charges (if applicable): Non-functional establishments may need to pay ₹75 (A/C No. 2) per month.

- Late Filing: Filing after the 15th of the subsequent month may attract late fees or penalties.

- Surrendering PF Code: If the organization has permanently closed, file Nil returns until the PF code is formally surrendered to avoid compliance issues.