Whether GST Audit applicable for FY 2019-20?

Union government in Finance Bill 2021 proposed to omit mandatory requirement of furnishing a reconciliation statement (GSTR-9C) duly audited by a practicing chartered accountant or cost accountant. Government proposes filing of the annual return (GSTR-9) on self-certification basis with a reconciliation statement.

Budget speech created confusion amongst taxpayers and professionals about applicability of GST audit for FY 2019-20 for which due date is 28/02/2021. Many stakeholders start asking is GST Audit abolished? GST audit abolished for FY 2019-20? What about form GSTR-9/9C?

Gst audit applicability for FY 2019-20 as per budget 2021

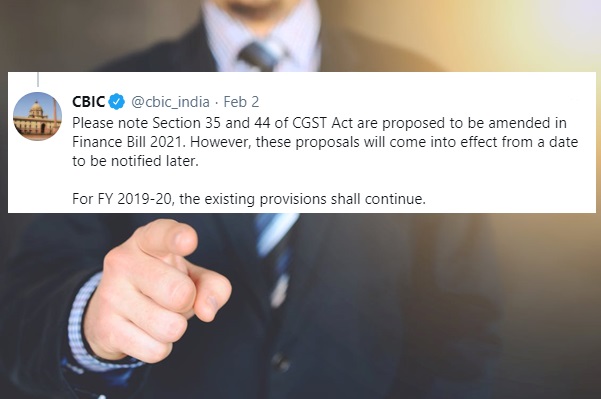

Based on queries received, CBIC clarified that GSTR9C duly audited by specified professionals is applicable for FY 2019-20 as changes will come into effect from a date to be notified later*. For FY 2019-20, the existing provisions shall continue. [*Notification no.29/2021- C.T. dated 30th July, 2021.]

It is important to note that, only certification by specified professionals removed but filing of annual return form GSTR9 and/or GSTR-9C not discontinued. GSTR-9/9C to be uploaded on self certification of taxpayers.

#GST #GST audit applicability for FY 2019-20 #Is GST audit abolished? #gst audit scrapped in budget 2021

GST Audit due date for FY 2019-20

Due date for filing GSTR-9 and/or 9C has been extended up to March 31st, 2021 vide notification 04/2021-CGST dated 28/02/2021. Earlier extended date was February 28th, 2021 vide Notification No. 95/2020 – Central Tax, dated December 30th, 2020. Original due date was 31st December 2020.