Are you GST Return non-filer? Here is what you should know about

procedure to be followed by GST department in case of non-filers.

Following is the procedure to be followed by GST department in cases of GST returns non-filers.

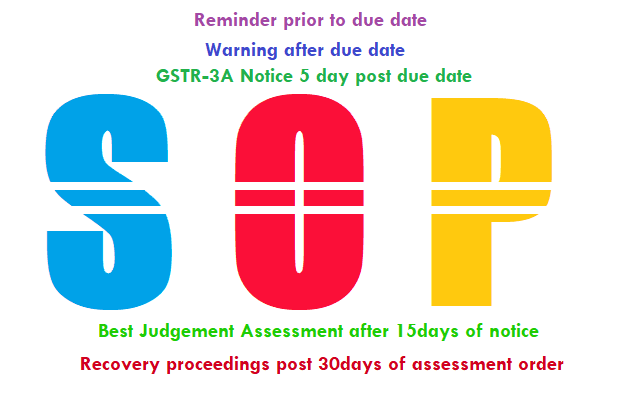

(i) At least 03 days Before due date of filing GST returns a system

generated message would be sent to all the registered persons to file return

within time.

generated message would be sent to all the registered persons to file return

within time.

(ii) After due date for furnishing the return under section 39 is over, a

system generated mail / message would be sent to all the defaulters immediately

after the due date , that the said registered person has not furnished his

return for the said tax period; the said mail/message is to be sent to the

authorized signatory as well as the proprietor/partner/director/karta, etc.

system generated mail / message would be sent to all the defaulters immediately

after the due date , that the said registered person has not furnished his

return for the said tax period; the said mail/message is to be sent to the

authorized signatory as well as the proprietor/partner/director/karta, etc.

(iii) Five days after the due date, a notice GSTR-3A (under section 46 of

the CGST Act read with rule 68 of the CGST Rules) shall be issued

electronically to such defaulter, giving him time of fifteen days to file

pending returns;

the CGST Act read with rule 68 of the CGST Rules) shall be issued

electronically to such defaulter, giving him time of fifteen days to file

pending returns;

(iv) In case defaulter fails to furnish pending returns within 15 days, the

proper officer may issue best judgement assessment order in Form

GST ASMT-13, declaring GST tax liability based on the details of

proper officer may issue best judgement assessment order in Form

GST ASMT-13, declaring GST tax liability based on the details of

a) outward supplies available in the FORM GSTR-1,

b) details of supplies auto populated in FORM

GSTR-2A,

GSTR-2A,

c) information available from e-way bills, or

d) any other information available from any other

source, including inspection under section 71;

source, including inspection under section 71;

(v) In case the defaulter furnishes a valid return within thirty days (30

days) of the service of assessment order in FORM GST ASMT-13,

days) of the service of assessment order in FORM GST ASMT-13,

The said assessment

order shall be deemed to have been withdrawn in terms of provision of

sub-section (2) of section 62 of the CGST Act.

order shall be deemed to have been withdrawn in terms of provision of

sub-section (2) of section 62 of the CGST Act.

However, no GST returns

filed within the statutory period of 30 days from issuance of order in FORM

ASMT-13, then proper officer may initiate proceedings under section 78 and

recovery under section 79 of the CGST Act;

filed within the statutory period of 30 days from issuance of order in FORM

ASMT-13, then proper officer may initiate proceedings under section 78 and

recovery under section 79 of the CGST Act;

Above general guidelines may be followed by the proper officer in case of

non-furnishing of return. In deserving cases, based on the facts of the case,

the Commissioner may resort to provisional attachment to protect revenue under

section 83 of the CGST Act before issuance of FORM GST ASMT-13.

non-furnishing of return. In deserving cases, based on the facts of the case,

the Commissioner may resort to provisional attachment to protect revenue under

section 83 of the CGST Act before issuance of FORM GST ASMT-13.

Further, the proper officer would initiate action under sub-section (2) of

section 29 of the CGST Act for cancellation of registration, if returns not

filed for

section 29 of the CGST Act for cancellation of registration, if returns not

filed for

a) Three consecutive tax

periods in case of composition tax payer

periods in case of composition tax payer

b) Six consecutive tax

periods in case of regular tax payer

periods in case of regular tax payer

#Read full text of CBIC notification here