Submit Letter of Undertaking (LUT) for the FY 2025-26 by March 31, 2025

Under GST Law, Export of goods or services can be made without payment of integrated tax under the provisions of rule 96A of the Central Goods and Services Tax Rules, 2017 (the CGST Rules). Under the said provisions, an exporter is required to furnish a bond or Letter of Undertaking (LUT) to the jurisdictional Commissioner before effecting zero-rated supplies. Notification No. 37 /2017 – Central Tax dated 04/10/2017 extended facility of filing LUT for all the taxpayers.

The validity of the LUT issued will be valid up to end of financial year, Hence, at the end of financial year, the registered supplier needs to apply for the renewal of LUT for the next year in order to continue making the exports without the payment of IGST. ( 🔗Circular No. 8/8/2017-GST) Accordingly, LUT issued during the Financial year 2024-25 is about to expire on 31/03/2025 and every registered exporter who desires to export the goods or services without payment of the IGST shall apply for renewal of Letter of Undertaking. To avoid last minute rush submit Letter of Undertaking (LUT) for FY 2025-26 by March 31st, 2025. GSTN has enabled filing of LUT for the FY 2025-26.

Procedure for LUT renewal:

Step by step Procedure for Renewal of Letter of Undertaking. The procedure for renewal is similar to the process of applying fresh LUT for FY 2025-26

Following are the steps for the LUT renewal or Application for LUT first time:

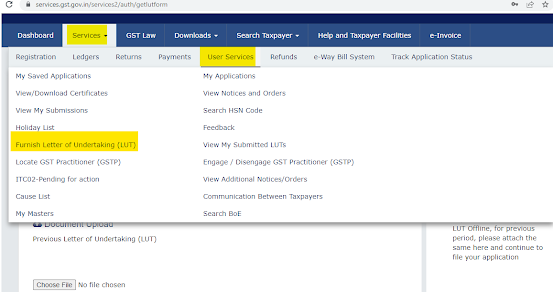

- Login to the GST portal, select Tab Service and go to User Services then, select “Furnishing Letter of Undertaking”

- Select the Financial year 2025-26 for which you want to renew or apply LUT for the first time.

- As you have furnished LUT for the previous period, attach the same and continue to file your application.

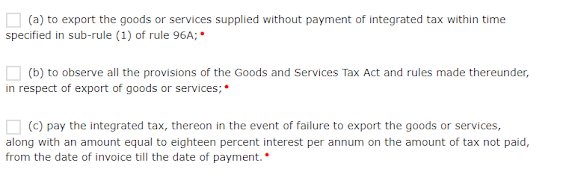

- Read and Select all the three check-boxes for accepting the conditions prescribed in Letter of Undertaking.

- Enter the details of two Independent witnesses.

- Select Authorised signatory and submit an application with EVC/DSC as the case may be.

- Do not forget to download generated acknowledgment along with form immediately. A LUT shall be deemed to have been accepted as soon as an acknowledgment for the same, bearing the Application Reference Number (ARN), is generated online. (vide 🔗Circular No. 40/14/2018-GST)

- P.S. as a GST practitioner kindly note that before furnishing LUT online, obtain physical signed copy of LUT from client along with details of independent witnesses to avoid future disputes.

Consequences if Letter of Undertaking (LUT) not submitted:

If you failed to furnish LUT before undertaking export transaction, GST department may deny export benefits and you have to pay IGST on your supply. However, Central Board of Indirect Taxes (‘CBIC’) vide 🔗circular no 125/44/2019 dated November 18, 2019 has clarified that the substantive benefit of zero-rated supply may not be denied where the exporter has delayed in furnishing LUT. Accordingly, LUT may be admitted on ex post facto basis, taking into account, facts and circumstance of each case.

#Read here about annual compliance w.r.t Import Export Code (IEC) update

#LUT # Renewal of LUT #LUT for the FY 2025-26 #GST_LUT #LUT_Renewal #LUT2026