All about Director KYC i.e. DIN KYC

DIR-3 KYC is an annual compliance process for all individuals who have been allotted a Director Identification Number (DIN) by the Ministry of Corporate Affairs (MCA). A DIN is a unique 8-digit identification number assigned to current or prospective directors of companies in India. Initially, obtaining a DIN was a one-time process via e-Form DIR-3, but since 2018, the MCA has mandated annual KYC updates to maintain accurate records of directors.

The process involves submitting personal and contact details through either the DIR-3 KYC e-Form or the DIR-3 KYC Web service, depending on the situation.

Who Needs to File DIR-3 KYC?

- All DIN Holders: Every individual with an approved DIN as of March 31st of a financial year must file DIR-3 KYC, regardless of whether they are currently a director in a company or not.

- Disqualified Directors: Even directors disqualified under the Companies Act, 2013, must file DIR-3 KYC if their DIN is still allotted.

- Foreign Directors: Foreign nationals with a DIN must also comply with DIR-3 KYC requirements.

- Exception: Individuals allotted a DIN after March 31st of a financial year are not required to file KYC for that year but must do so in the following year.

For example, if a DIN was allotted on or before March 31, 2025, the individual must file DIR-3 KYC by October 15, 2025, for FY 2024-25.

Types of Forms for Doing DIN KYC

There are two methods to complete DIN KYC, depending on the director’s filing history and updates required:

- DIR-3 KYC e-Form:

- Used by:

- DIN holders filing KYC for the first time.

- DIN holders updating details (e.g., mobile number, email, address) since their last filing.

- DIN holders with deactivated DINs due to non-filing, who need to reactivate it.

- Requires a Digital Signature Certificate (DSC) from the director and certification by a practicing professional (CA, CS, or Cost Accountant).

- Used by:

- DIR-3 KYC Web:

- Used by DIN holders who:

- Have already filed DIR-3 KYC in a previous year.

- Have no changes in their KYC details (e.g., mobile number or email).

- A simpler process that does not require a DSC or professional certification—just OTP verification.

- Used by DIN holders who:

Due Date for Filing DIN KYC for FY 2025 extended

- The deadline for filing DIR-3 KYC is September 30th of the next financial year following the year in which the DIN was active as of March 31st.

- For FY 2024-25 (DIN active as of March 31, 2025), the original due date was September 30, 2025, however ministry vide circular no 04/2025 dated 29th September 2025 extended this date up to 15th October 2025. This further extended up to 31st Oct 2025

Fees and Penalties for DIN KYC

- No Fee: If filed by the due date (October 15th*), there is no government fee for either method.

- Late Filing Penalty: If filed after the due date, a penalty of ₹5,000 applies, and the DIN is marked as “Deactivated due to non-filing of DIR-3 KYC.” Reactivation requires filing with the penalty.

Consequences of Non-Filing of DIR-3 KYC

- DIN Deactivation: The MCA marks the DIN as “Deactivated” after September 30th*[or extended date] if KYC is not filed, restricting the individual from filing company-related forms (e.g., DIR-12, annual returns).

- Company Impact: Companies with directors having deactivated DINs may face compliance issues or penalties. Such deactivated DINs can’t be used as signatories to any MCA forms.

How to Change Mobile Number or Email ID of Directors

- Free Change: File DIR-3 KYC (e-Form or Web, depending on prior filing history) between April 1st and October 15th with no fee.

- Paid Changes: If a director wishes to update their mobile number or email ID again within the same financial year (beyond the free update allowed during the annual filing), they can do so at any time by submitting the e-Form DIR-3 KYC along with a fee of ₹500 per update.

Declaration and Engagement letter from the DIN holder should be obtained if you are filing on behalf of someone else, i.e., professionals must obtain an engagement letter.

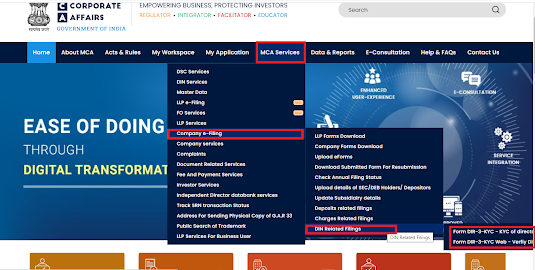

Navigation for DIN KYC on MCA V3 portal. DIN KYC can be done post login only. Registered user can file web kyc but for filing eForm DIR-3 KYC business user registration needed.