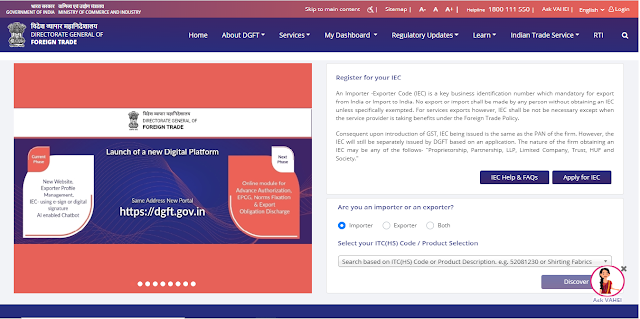

What is IEC?

a) Valid Login Credentials to DGFT Portal.

b) User should have an active Firms Permanent Account Number (PAN) and its details like Name as per Pan, Date of Birth or Incorporation. Note: These details will be validated with the Income Tax Department site.

c) Scanned documents for Upload in the System (PDF Only and Max file size of 5 MB).

a. Proof of establishment/incorporation/registration.

i. Partnership

ii. Registered Society

iii. Trust

iv. HUF

v. Others

b. Proof of Address can be any one of the following documents:

i. Sale Deed, rent agreement, lease deed, electricity bill, telephone land line bill, mobile, postpaid bill, MoU, Partnership deed

ii. Other acceptable documents (for proprietorship only): Aadhar, passport, voter id

iii. In case the address proof is not in the name of the applicant firm, a no objection certificate (NOC) by the firm premises owner in favor of the firm along with the address proof is to be submitted as a single PDF document.

c. Proof of Firm’s Bank Account

i. Cancelled Cheque [ with pre-printed name] or

ii. Bank Certificate

d) User should have an active DSC or Aadhaar of the firm’s member for submission.

e) Active Firm’s Bank account for entering its details in the Application and to make online payment of the application fee.

Here is the step by step procedure for IEC application: