Short-Term and Long-Term Capital Assets:

• Definition: According to Section 2(42A), a short-term capital asset is a capital asset held by an assessee for no more than 36 months immediately before the date of its transfer. However, from July 23, 2024, any capital asset held for no more than 24 months immediately preceding its transfer will be considered a short-term capital asset.

• As per Section 2(29A), a long-term capital asset is a capital asset that is not a short-term capital asset. Based on the holding period, capital assets are classified as short-term or long-term as follows:

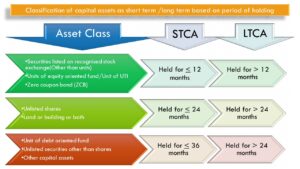

Classification of capital assets as short term and long term before July 23, 2024

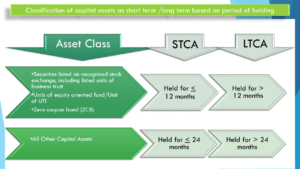

Classification of capital assets as short term and long term on or after July 23, 2024

W.e.f. 23rd July 2024 period of holding reduced to 24 moths as against previous 36 months.

Meaning of abbreviation used:

STCA: Short term capital asset

LTCA: Long term capital asset