Website guidelines for Chartered Accountants

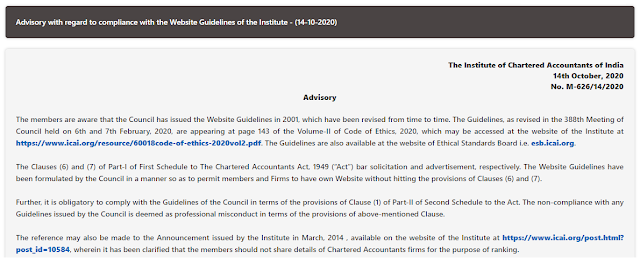

Planning to develop website? Then you must be aware of what and which type of contents are prohibited. The Guidelines, as revised in the 388th Meeting of Council held on 6th and 7th February, 2020, are appearing at page 143 of the Volume-II of Code of Ethics, 2020.

Planning to develop website? Then you must be aware of what and which type of contents are prohibited. The Guidelines, as revised in the 388th Meeting of Council held on 6th and 7th February, 2020, are appearing at page 143 of the Volume-II of Code of Ethics, 2020.

Following contents and features on the Websites of members and firms are prohibited:-

(1) Mention of Names of clients / Client Logo

(2) Writing of Firm name in a manner tanta mounting to Logo/Monogram

(3) Mention of Professional Fees, or fact of providing services free of charge

(4) Using Photographs other than passport style, including Event galleries of Photographs

(5) Use of expressions such as “Leading Firm”/”Best Firm”/ “Top Firm”

(6) Claiming to have liasoning with Government offices

(7) Mention of activities forming other business or occupation, which are not allowed to members in practice e.g. Real Estate, Health , etc.

(8) Mention of activities forming other business or occupation allowed to members in practice e.g. reference of Books authored, teaching activities by the member concerned, etc. (since the website can be utilized for mentioning professional services of members only, and not of other business /occupation carried out by him)

(9) Mention of activities which exceed the purview granted to members in practice e.g. “Arrangement of Loans” (the members in practice are permitted to act as Financial Adviser in terms of Regulation 191 of Chartered Accountants Regulations, 1988)

(10) Links of organizations which do not fall under permitted categories e.g. of a commercial Company

(11) Videos other than educational videos e.g. Firm profile, canvassing for Elections etc.

(12) Mentioning subjective claims e.g. “having presence/associates in big cities”, “have well equipped Conference Room”, “best quality services in the market” etc.

(13) Mentioning CSR contribution / donation done by the Firm

(14) Mentioning any kind of affiliation with any national or international organisation e.g. United Nations

(15) Mention of any award(s) as may have been given to the CA Firm

(16) Mention of any kind of grading granted to the Firm by any organization (including a Regulator) or a survey agency e.g. “Tier 2 Firm”

(17) Mentioning of a particular role instead of professional service e.g. “Training” (which may be provided to existing clients w.r.t a professional service, but cannot be mentioned as a service)

(18) Professional services of the Firm mentioned in push mode/ the website running on a push model of technology

(19) Mention of media coverage of Firm

(20) Mention of association of the member with the Institute e.g. as a Special Invitee in a Committee of the Institute

(21) Mentioning testimonial with client name

(22) ISO Certification or any other certification or accreditation (it is allowed for CA Firms to have ISO certification, but the same cannot be mentioned)

(23) Using Logo of a Government Department or scheme e.g. of Startup India

(24) Mention of updates which do not fall under the category of professional updates e.g. relating to movies, National and International News

(25) Mention of empanelment with any organisation, whether for Audit or any other assignment

(26) Mention of engagement of the Firm in social activity(ies)

(27) Mention of features like “why choose us” on the website

(28) Mentioning association/reference of any other Firm(s) , wherein the proprietor or partner of the Firm may be partner

(29) Advertisement of any commodity, service or entity.

It may be noted that the above list is not exhaustive. In order that the members remain in the purview of the provisions of the Act and Code of Ethics, the members are hereby advised to align their websites with the Website Guidelines and remove all such contents and features which are not in consonance with the said Guidelines.Website guidelines for Chartered Accountants