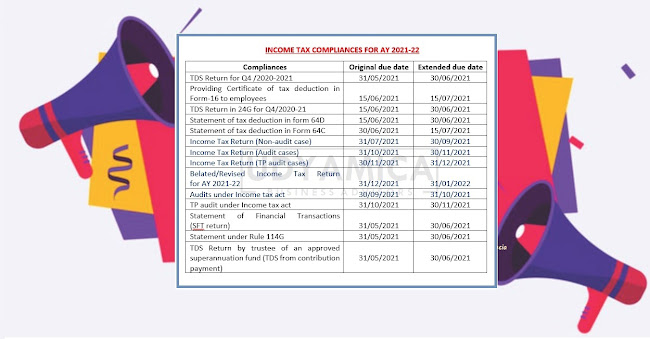

Due date for filing income tax returns and tax audit reports for AY 2021-22 extended

1) SFT due date: The Statement of Financial Transactions (SFT) for the Financial Year 2020- 21, required to be furnished on or before 31st May 2021 under Rule 114E of the Income-tax Rules, 1962 (hereinafter referred to as the Rules) and various notifications issued thereunder , may be furnished on or before 30th June 2021;

2) The Statement of Reportable Account for the calendar year 2020, required to be furnished on or before 31st May 2021 under Rule 114G of the Rules, may be furnished on or before 30th June 2021;

3) TDS return due date for FY 2020-21 Q4: The Statement of Deduction of Tax for the last quarter of the Financial Year 2020-21, required to be furnished on or before 31st May 2021 under Rule 31A of the Rules, may be furnished on or before 30th June 2021*;

* CBDT further extended this due date for filing Q4 TDS returns till 15th July 2021 – Circular 12/2021 dated 25th June 2021

4) Form-16 due date: The Certificate of Tax Deducted at Source in Form No 16, required to be furnished to the employee by 15th June 2021 under Rule 31 of the Rules, may be furnished on or before 15th July 2021**;

**Form 16A can be issued till 30th July 2021 & Form 16 till 31st July 2021 –Circular 12/2021 dated 25th June 2021

5) TDS return in Form 24G: The TDS/TCS Book Adjustment Statement in Form No 24G for the month of May 2021, required to be furnished on or before 15th June 2021 under Rule 30 and Rule 37CA of the Rules, may be furnished on or before 30th June 2021;

6) The Statement of Deduction of Tax from contributions paid by the trustees of an approved superannuation fund for the Financial Year 2020-21, required to be sent on or before 31st May 2021 under Rule 33 of the Rules, may be sent on or before 30th June 2021;

7) Form NO 64D due date: The Statement of Income paid or credited by an investment fund to its unit holder in Form No 64D for the Previous Year 2020-21 , required to be furnished on or before 15th June 2021 under Rule 12CB of the Rules, may be furnished on or before 30th June 2021;

8) Form NO 64C due date: The Statement of Income paid or credited by an investment fund to its unit holder in Form No 64C for the Previous Year 2020-21 , required to be furnished on or before 30th June 2021 under Rule 12CB of the Rules, may be furnished on or before 15th July 2021;

9) Income tax return for AY 2021-22(Non-audit cases): The due date of furnishing of Return of Income for the Assessment Year 2021-22 , which is 31st July 2021 under sub-section (1) of section 139 of the Act, is extended to 30th September 2021; #Final extended up to 31st Dec 2021.

10) Income Tax audit report: The due date of furnishing of Report of Audit under any provision of the Act for the Previous Year 2020-21, which is 30th September 2021, is extended to 31st October 2021; #Final extended up to 15th February 2022.

11) TP audit report: The due date of furnishing Report from an Accountant by persons entering into international transaction or specified domestic transact ion under section 92E of the Act for the Previous Year 2020-21, which is 31st October 2021, is extended to 30th November 2021;#Final extended up to 15th February 2022.

12) Income tax return for AY 2021-22(Audit cases): The due date of furnishing of Return of Income for the Assessment Year 2021-22, which is 31st October 2021 under sub-section (1) of section 139 of the Act, is extended to 30th November 2021; #Final extended up to 15th March 2022.

13) Income tax return for AY 2021-22(TP audit cases) The due date of furnishing of Return of Income for the Assessment Year 2021-22, which is 30th November 2021 under sub-section (1) of section 139 of the Act, is extended to 31st December 2021; #Final extended up to 15th March 2022.

14) Belated/revised ITR due date AY 2021-22: The due date of furnishing of belated/revised Return of Income for the Assessment Year 2021-22, which is 31st December 2021 under sub-section (4)/sub-section (5) of section 139 of the Act, is extended to 31st January 2022. #Final extended up to 31st March 2022.

Summary of Circulars 09/2021, 12/2021, 17/2021 & 01/2022 :

| Particulars | Due Date | Circular 09/2021 | Circular 12/2021 | Circular 15/2021 | Circular 17/2021 | Circular 01/2022 |

|---|---|---|---|---|---|---|

| Original | First extension | Second extension | Third extension | Fourth extension | Final extension | |

| Statement of Financial Transactions (SFT) for FY 2020-21 | 31-May-2021 | 30-Jun-2021 | – | – | – | – |

| Statement of Reportable Account for CY 2020 | 31-May-2021 | 30-Jun-2021 | – | – | – | – |

| TDS Return Q4 FY 2020-21 | 31-May-2021 | 30-Jun-2021 | 15th July 2021 | – | – | – |

| Form 16 (TDS Certificate) | 15-Jun-2021 | 15-Jul-2021 | 30th July 2021 | – | – | – |

| TDS/TCS Book Adjustment Statement (Form 24G) for May 2021 | 15-Jun-2021 | 30-Jun-2021 | – | – | – | – |

| Statement of Deduction (Superannuation Fund) FY 2020-21 | 31-May-2021 | 30-Jun-2021 | – | – | – | – |

| Form 64D (Income Paid by Investment Fund) for FY 2020-21 | 15-Jun-2021 | 30-Jun-2021 | 15-Jul-2021 | 15-Sep-2021 | – | – |

| Form 64C (Income Paid by Investment Fund) for PY 2020-21 | 30-Jun-2021 | 15-Jul-2021 | 31-Jul-2021 | 30-Sep-2021 | – | – |

| Return of Income (Individuals & Non-Audit Cases) for AY 2021-22 | 31-Jul-2021 | 30-Sep-2021 | – | – | 31-Dec-2021 | – |

| Tax Audit Report for AY 2021-22 | 30-Sep-2021 | 31-Oct-2021 | – | – | 15-Jan-2022 | 15-Feb-2022 |

| Report under Section 92E (Transfer Pricing) for AY 2021-22 | 31-Oct-2021 | 30-Nov-2021 | – | – | 31-Jan-2022 | 15-Feb-2022 |

| Return of Income (Audit Cases) for AY 2021-22 | 31-Oct-2021 | 30-Nov-2021 | – | – | 15-Feb-2022 | 15-Mar-2022 |

| Return of Income (TP Audit Cases) for AY 2021-22 | 30-Nov-2021 | 31-Dec-2021 | – | – | 28-Feb-2022 | 15-Mar-2022 |

| Belated/Revised Return for AY 2021-22 | 31-Dec-2021 | 31-Jan-2022 | – | – | 31-Mar-2022 | – |